Forex scandal: Market rigging techniques

Forex scandal: Market rigging techniques

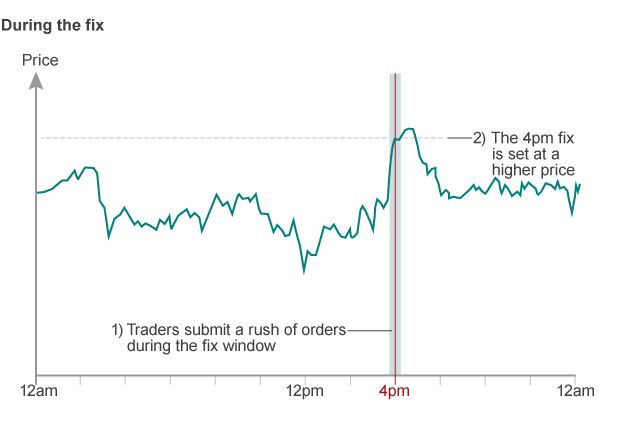

The foreign exchange market, while not easily manipulatable, still offers opportunities for traders to influence currency values for profit. This market operates 24/7, making it challenging to determine its exact worth on any given day. To gauge activity levels, institutions often take snapshots of buy and sell volumes. Until recently, this occurred within a 30-second window around 4:00 PM in London, known as the 4pm fix. This daily fix plays a pivotal role in various financial markets.

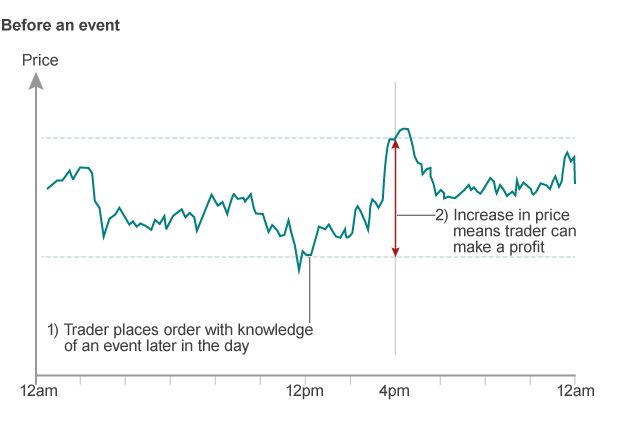

To sway currency prices as desired, traders can place a flurry of orders during the fix’s timeframe. This influx of orders can distort perceptions of supply and demand, ultimately altering prices. Such manipulation may involve access to confidential information about impending events that could influence prices. For instance, traders may share internal details about their clients’ orders and trading positions. Armed with this knowledge, traders can strategically place their own orders or sales to capitalize on ensuing price shifts. This manipulation can also be linked to the 4pm fix, where traders position themselves ahead of anticipated events around that time.

.gif)

Manipulating prices is more effective when multiple market participants collaborate. Through agreements to execute orders simultaneously or by sharing confidential data, prices can be more drastically influenced, leading to greater profits. Collusion may take an “active” form, where traders communicate directly through phone calls or internet chatrooms. Alternatively, it can be “implicit,” where traders don’t communicate but remain aware of others’ intentions in the market.

In November, the UK’s Financial Conduct Authority (FCA) provided examples of traders at banks using nicknames like “the players,” “the 3 musketeers,” “1 team, 1 dream,” and “the A-team” to manipulate foreign exchange markets. The FCA revealed that traders from different firms, including HSBC and Citi, conspired to influence currency fixes. They shared confidential information about client orders and orchestrated trades to their advantage.

The manipulations in the foreign exchange market generally result in minor price shifts that are inconspicuous to ordinary consumers. However, companies found guilty of manipulation can face substantial financial penalties. Such actions can also harm the value of pension funds and investments, eroding trust in the financial system, which has been marred by a series of scandals.

Get back to Seikom News 🤓