What Happens Next? Oct. 2021

What Happens Next? Oct. 2021

A month ago, we anticipated that global monetary policy would take center stage in financial market discussions. The September meeting of the U.S. Federal Reserve (“Fed”) didn’t reveal any groundbreaking information, and the general expectation remains that the Fed will unveil its plan to reduce asset purchases during its November 2021 meeting. Other central banks, like the Bank of England, have hinted at the possibility of raising short-term interest rates earlier than what the market had anticipated. In our assessment, changes in monetary policy currently represent the most prominent known risk in financial markets. As we enter October, we anticipate that corporate earnings will become the primary focus, with the inflation debate somewhat receding into the background.

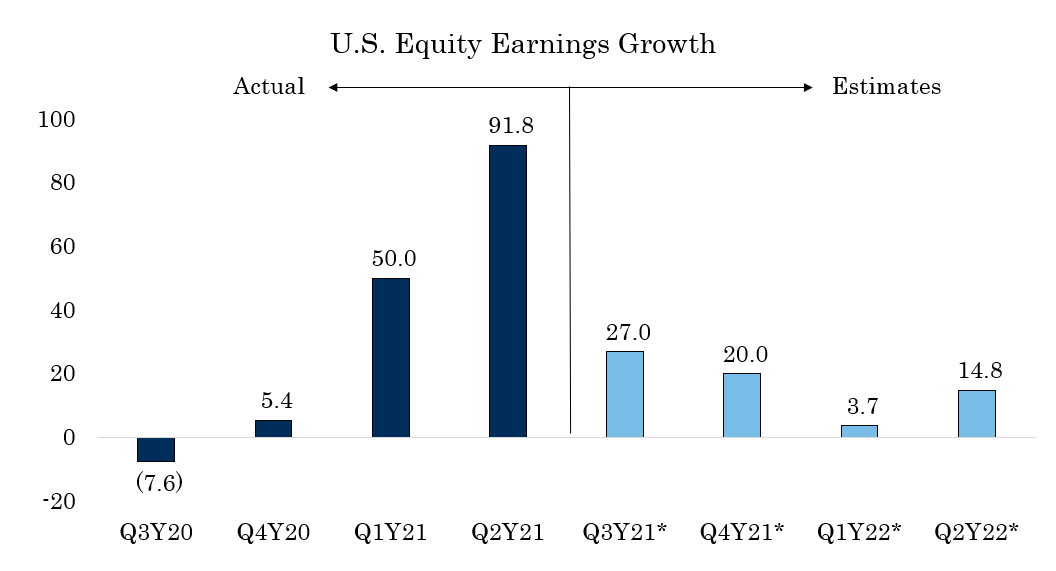

Earnings Growth Slowing Down

In the last quarter, U.S. equities witnessed a remarkable 91% earnings growth compared to the second quarter of 2020. Part of this growth can be attributed to a low starting point, but the substantial monetary and fiscal stimulus likely played a role as well. This quarter, the market is anticipating roughly a 28% growth rate (Q3 2021 vs. Q3 2020), and if realized, it would be the third-highest on record. Therefore, while earnings growth in the U.S. equity market is set to decelerate, it will still be considerably above historical averages. By the end of October, approximately 70% of S&P 500 companies will have reported their Q3 2021 results.

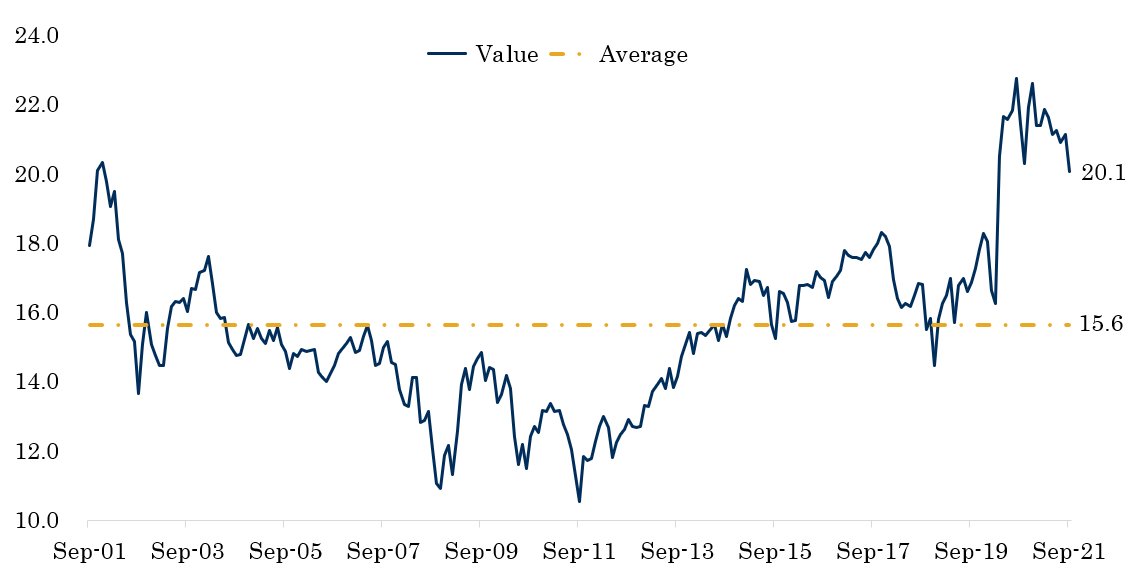

Elevated Valuations

Valuations in U.S. equity markets are relatively high. With a forward S&P 500 price-to-earnings (“PE”) ratio of 20.9x for the next twelve months, it significantly exceeds the twenty-year average of 15.6. While lofty valuations don’t necessarily imply imminent trouble, they do pose a substantial headwind in our view. For instance, if we create a simple model to estimate the annualized total return over the next five years based on the current S&P 500 forward PE ratio and ten-year interest rates, the model suggests a 9% annualized return. While a 9% annualized return may appear attractive, it is comparatively lower than the annualized return over the past five years (+16.90%). Given the high valuations and above-average earnings growth expectations, any disappointment in Q3 2021 corporate earnings results is likely to result in more significant downward movements than we have witnessed so far this year.

The Inflation Debate

In August, the U.S. Consumer Price Index indicated a 5.3% increase compared to the previous year. Excluding food and energy, the CPI registered a 4% increase over the past year. It’s a crucial reminder that the economy and financial markets should not be conflated. The Federal Reserve, the largest participant in financial markets, has expressed its belief that inflation will subside as supply chain bottlenecks are resolved. If the Fed achieves its inflation and employment objectives, it will begin tapering asset purchases and raising short-term interest rates. The CPI reading for September, set to be released on October 13th, may not definitively settle this debate, but it will certainly be closely watched by many participants in financial markets.

With less than three months remaining in the year, we anticipate that macroeconomic headlines will exert a more substantial influence on financial markets than their microeconomic counterparts. The most significant macroeconomic driver in today’s financial markets is global monetary policy. Changes in monetary policy give rise to the following financial market questions: When will monetary policy transition from accommodative to contractionary, and by how much? Can financial markets continue to perform when monetary policy shifts from being a tailwind to a headwind? How will corporations collectively navigate above-average inflation and waning fiscal/monetary stimulus? Will growth rates remain robust enough to offset elevated valuations? While answers to these questions will take months or even years to materialize, we believe that taking an active approach will yield more favorable outcomes than adopting a passive stance in the current market environment.

Get back to Seikom News 🤓